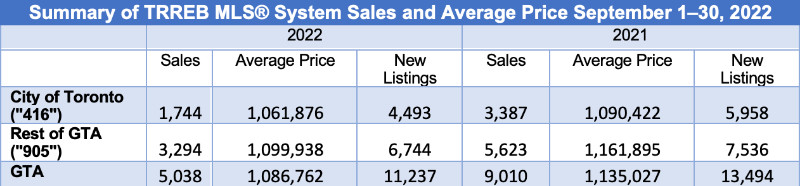

TORONTO, ONTARIO, October 5, 2022 – The Greater Toronto Area (GTA) housing market continued its adjustment to higher borrowing costs in September 2022. Sales for the month reached 5,038, but were down by 44.1 per cent compared to September 2021.

New listings were also down on a year-over-year basis by 16.7 per cent to 11,237. This was the lowest number of new listings reported for the month of September since 2002. This is especially troublesome given that the stock of homes in the GTA increased markedly over the last 20 years.

Recent polling by Ipsos Public Affairs for TRREB1 suggests that the public agrees the lack of housing supply is a key issue in the GTA. The poll found that 71 per cent of combined Toronto and ‘905’ regions residents believe that municipalities should focus their efforts on increasing the supply of homes for sale and rent rather than trying to reduce demand for housing.

“We must ensure that the temporary dip in housing demand is not allowed to mask the critical shortage of homes available for sale in the GTA. Candidates running in the upcoming Ontario municipal elections must ensure home buyers and renters have adequate housing options in the years to come. Municipal council decisions have a direct impact on housing affordability, in terms of the protracted development approval processes, high development fees and other related policies that preclude timely housing development,” said TRREB President Kevin Crigger.

“Elected councils must also reconsider existing policies that preclude homeowners from listing their homes for sale, including significant added upfront costs like the land transfer tax. Potential new policies like mandatory home energy audits could also create unnecessary interference and delays in the home selling process and dissuade some homeowners from listing their homes for sale,” said TRREB CEO John DiMichele.

“Energy audits should be voluntary, a feeling which is supported 73 per cent of Torontonians and 78 per cent of ‘905’ residents recently polled by Ipsos Public Affairs for TRREB. If councils continue to support policies that restrict new home development and existing home listings, such as exclusionary zoning, housing affordability will be severely hampered over the long term, which will also hamper our region’s future growth,” added DiMichele.

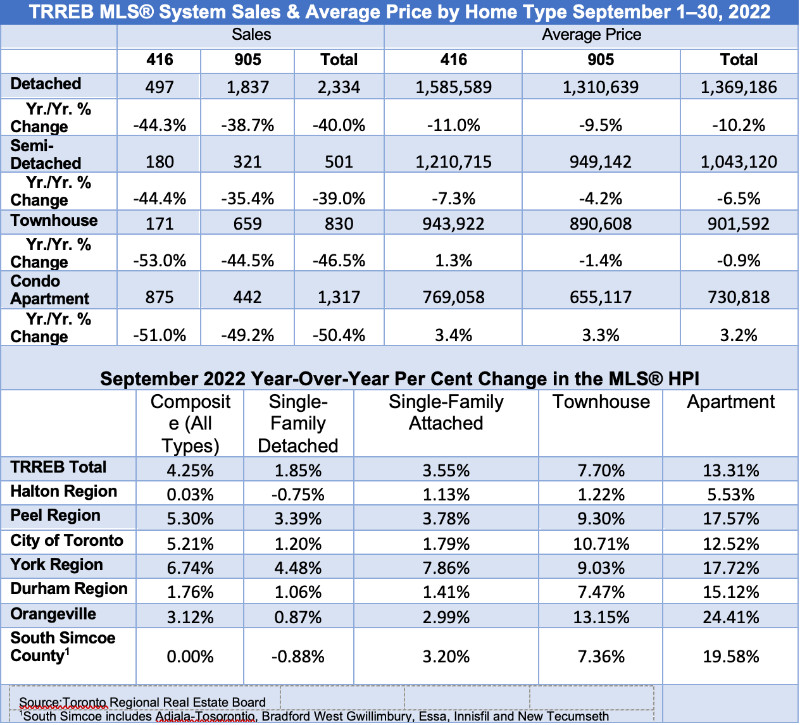

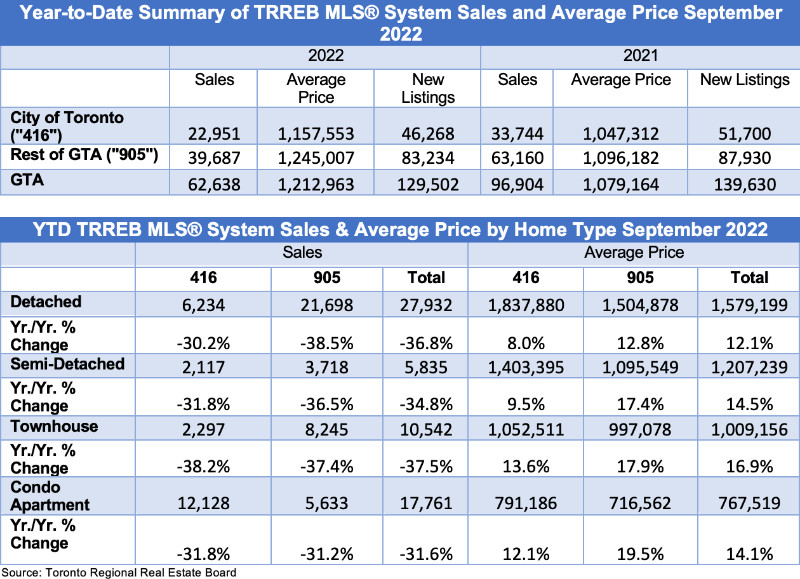

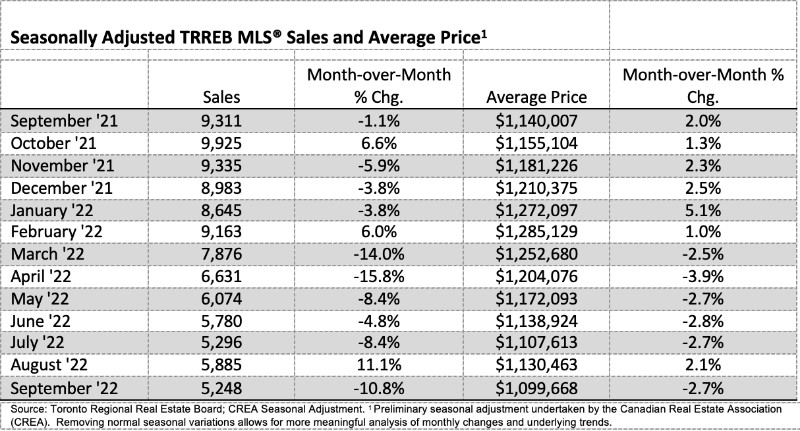

The MLS® Home Price Index (HPI) Composite benchmark was up on a year-over-year basis by 4.3 per cent. Over the same period of time, the average price dipped by 4.3 per cent to $1,086,762. The average price was up compared to August 2022.

“Hovering just below $1.1 million, the average selling price may have found some support during the last couple months of summer. With new listings down quite substantially year-over-year and well-below historic norms, some home buyers are quite possibly experiencing tighter market conditions in some GTA neighbourhoods. October generally represents the peak of the fall market, so it will be important to see where price trends head over the next month,” said TRREB Chief Market Analyst Jason Mercer.

To learn more about the housing affordability issues affecting GTA residents, visit GiveMeOptions.ca

Please note the methodology used to calculate MLS® HPI has been changed. For more information, click HERE.

READ THE FULL REPORT.

Notes

1 This Ipsos poll was commissioned by TRREB. Polling took place between September 12 to September 27, 2022, and was conducted online via Ipsos’ i-Say panel. There was a total of n=1002 respondents, n=515 GTA 416 and n=486 from GTA 905. The margin of error with this sample size is +/- 3.5 percentage points.

Media Inquiries:

Genevieve Grant, Manager,Public Affairs genevieve(dotted)grant(at)trreb(dotted)ca 416.443.8159

The Toronto Regional Real Estate Board is Canada’s largest real estate board with more than 68,000 residential and commercial professionals connecting people, property and communities.